By Natalie Gross

The Military Times story here.

A bipartisan pair of lawmakers are teaming up to try to make franchising opportunities more accessible to veterans.

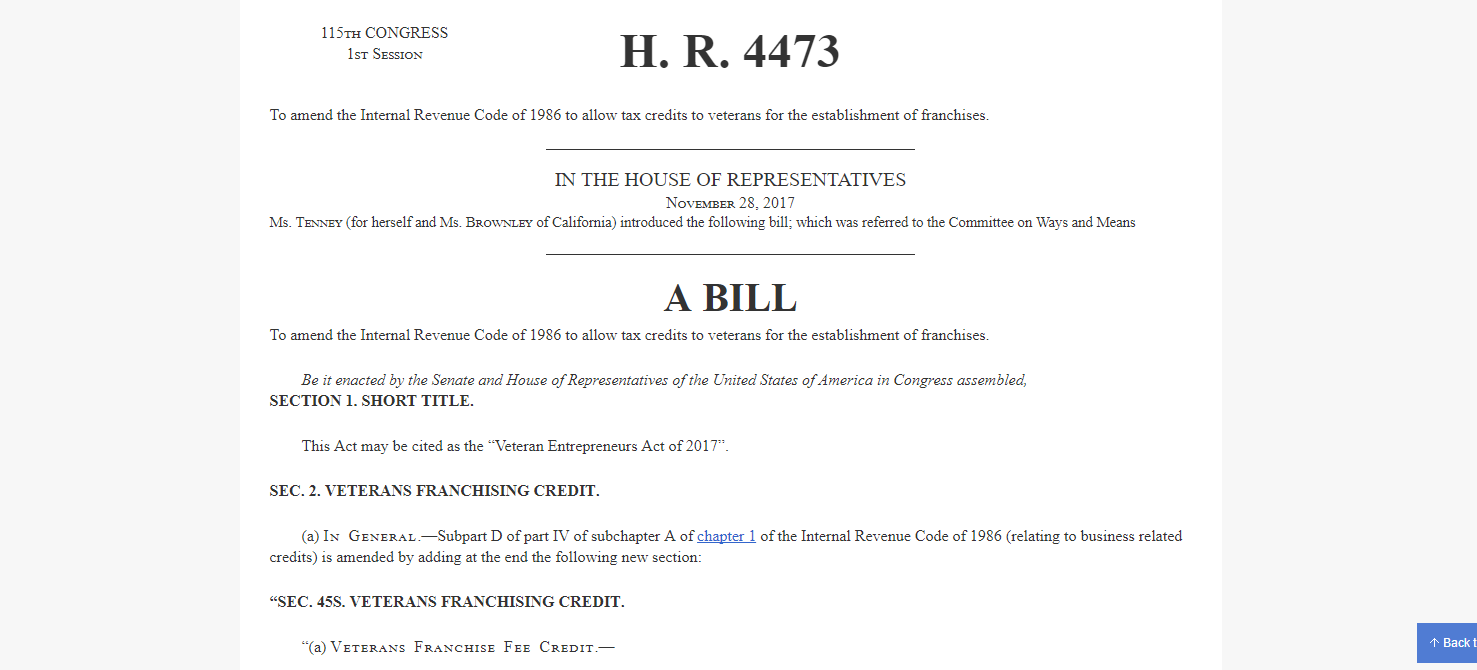

U.S. Reps. Julia Brownley, D-Calif., and Claudia Tenney, R-N.Y., on Tuesday introduced the Veteran Entrepreneurs Act of 2017 — legislation that would create a tax credit to cover 25 percent of initial fees for veteran franchisees, if passed.

“Veterans have the leadership skills needed to succeed in small business ownership, but frequently they are not financially able to manage the up-front costs,” Brownley said in an email. “Making small business ownership — including franchises — more accessible will better enable more veterans and their families to thrive.”

Franchise fees vary widely by industry, but the average is about $30,000 to $50,000, said Suzanne Beall, assistant vice president of government relations for the International Franchise Association, which runs the VetFran initiative. According to the organization’s latest research, one out of every seven franchises is owned by a veteran.

“We’re 100 percent supportive of the entire bill,” Beall said.

Representatives from veteran service organizations also expressed their support for the legislation this week.

“The American Legion has advocated for increased entrepreneurship opportunities for veterans for decades, and we support legislation that reduces barriers to entry for veterans looking to start businesses,” the group’s spokesman, Joe Plenzler, said in an email. “It is important to remember that access to capital to start a business and networking in the business community remain the number one and number two hurdles facing ‘vetrepreneurs’ today.”

Veterans of Foreign Wars Associate Director Patrick Murray said in an email the organization has partnerships with the franchises Sports Clips and Burger King and “strongly (supports) efforts to provide business minded veterans the opportunity to become entrepreneurs.”

The tax credit proposed in the legislation would apply to franchise fees under $400,000. Eligible veterans could also opt to transfer the tax credit to their franchisors in exchange for a discounted fee.

Tenney’s spokeswoman, Hannah Andrews, said the congresswomen hope the bill will move quickly through the House, and Brownley’s advocacy as a member of the House Committee on Veterans Affairs could help.

“We would hope that it would move really fast,” Andrews said. “We have an administration, and we have a Congress that’s really focused on economic growth and, I would say, is equally focused on our veterans.”